US

monetary policy has missed its mark and it is a handful of emerging markets that

look set to pay the price

The big guns of monetary policy used to

combat sluggish economic growth are about to be put away but the real damage

may be just about to kick in. The

Federal Reserve adopted loose monetary policy to get the US economy moving

again but it is elsewhere where the effects have been felt the most. Having benefited more from the loose monetary

policy than the intended target, some emerging markets look set to suffer as a policy

reversal prompts US investors to stage a destructive retreat back home.

Danger

zone

The proverbial printing presses at central

banks are like the heavy artillery of monetary policy. Central banks such as the Federal Reserve had

been pumping out cash to buy bonds as part of quantitative easing. Yet, the US economy had failed to fire up

with companies unwilling to invest while spending remains weak. Investors with cash in hand turned their

sights overseas and targeted emerging markets where economic growth was still

perky.

The surplus US dollars helped to lower

interest rates for borrowers in many countries which had not gotten caught up

in the global financial crisis. The

reduced borrowing costs pushed up lending elsewhere despite not having the same

effects in the US economy. The muted

effects of monetary policy in the domestic economy prompted the Federal Reserve

to unleash even more firepower. Money,

like some things, is fine in moderation but the bombardment of US dollars

inadvertently created its own minefield.

The surplus US dollars helped to lower

interest rates for borrowers in many countries which had not gotten caught up

in the global financial crisis. The

reduced borrowing costs pushed up lending elsewhere despite not having the same

effects in the US economy. The muted

effects of monetary policy in the domestic economy prompted the Federal Reserve

to unleash even more firepower. Money,

like some things, is fine in moderation but the bombardment of US dollars

inadvertently created its own minefield.

Borrowers in emerging market were only

given access to cheap cash by borrowing in US dollars for a short period of

time. This was fine as long as the prospects

for the US economy were poor and US dollars were readily available. But any significant improvement in the US

economy would see investors shift their money back. A stronger US economy would also push up the

value of the US dollar and make it tougher for overseas borrowers to pay off

any debts in US dollars.

Collateral

damage

Like solider stationed in a hostile region,

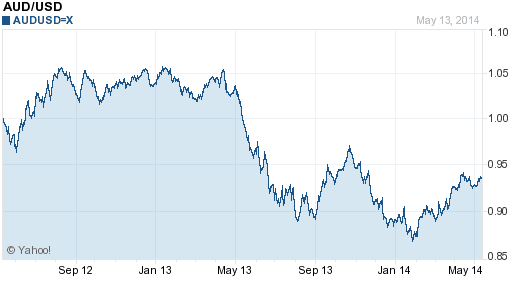

investors were set up to bail when the opportunity arose. Just the mere mention by the Federal Reserve

in May 2013 that quantitative easing might be coming to an end was enough to

trigger a rush by investors to get their money out. Six

months of market volatility followed even though quantitative easing did not

actually end until October 2014. With

the Federal Reserve now mulling lifting interest rates up from their low

levels, more upheaval seems likely.

This is because money often does more

damage on the way out compared to the gains when it is initially welcomed. Yet, the lure of cheap cash is too much to ignore. Even the financial sectors in richer countries

have shown themselves to be unable to cope when too much money is on offer.

Less developed banking systems in emerging markets are often even worse

at putting any cash to good use. This

increases the likelihood that many borrowers will struggle when US dollars are

harder to come by.

As the aftermath of the global financial

crisis has made painfully clear, a swift end to a lending boom is not something

easy to get over. In its attempts to deal

with an US economy sagging under the weight of excess debt, the Federal Reserve

has inflicted the same woes on others who are less able to deal with the consequences.

Like any form of warfare, it is the innocent victims that suffer the

most.