Diverging fortunes of

countries down under illustrate how China is changing

Trading with China can be like a roller coaster ride – lots

of ups and downs without knowing what is coming next. At a time when most of the global economy has

been in the doldrums, tapping into the Chinese market has lifted the economies

of a lucky few. Australia and New

Zealand are among the fortunate ones, but the diverging fortunes of these two

countries highlight a shift in China’s development which will have profound

effects for many others.

Riding out the twists

and turns

Economic development of any country is never a smooth

ride. Growth in China has been bumpier

than most with its economy jumping into life at a time when the world was

becoming a much smaller place due to globalization. The Chinese economy has expanded at an

unprecedented pace due to its role as a manufacturing base built on access to foreign

markets and funds from overseas. This has resulted in greater scarcity of many

of the basic commodities extracted from or grown in the ground.

Countries fortunate enough to possess an abundance of

natural resources, such as many in South America and Africa, gained a boost

from high commodity prices at a time when the global economy is weak. But these benefits are likely to be a

temporary upturn with demand for commodities shifting as China develops. The initial stages of the growth in China came

through investment amid a building frenzy as firms rushed to put up factories

to produce goods for exporting. This has

continued as the Chinese government has ramped up spending on infrastructure to counteract the

weak global economy.

The result has been a prolonged period of China sucking in resources

such as iron ore, coal, and natural gas.

However, spending on investment was surging ahead at a pace which could

not continue and has shown signs of an inevitable tailing off over the past

year or so. The government has instead

eyed consumption as a new source of economic growth and as a means to keep the

population happy. This change in focus

in China will be felt throughout the global economy.

Good and bad of

changes in China

China was at the forefront of the mind of Your Neighbourhood

Economist during a recent visit back home to New Zealand and a side trip to

Australia. Demand from China helped both

countries to avoid a downward spiral following the global financial crisis,

with Australia racking up an astounding 22 years without a recession. Yet, it is Australia that is looking

nervously at developments in China while New Zealand is looking to raise

interest rates due to a booming export industry.

China was at the forefront of the mind of Your Neighbourhood

Economist during a recent visit back home to New Zealand and a side trip to

Australia. Demand from China helped both

countries to avoid a downward spiral following the global financial crisis,

with Australia racking up an astounding 22 years without a recession. Yet, it is Australia that is looking

nervously at developments in China while New Zealand is looking to raise

interest rates due to a booming export industry.

The reason for concern among Australians is that its mining

boom is starting to peter out. Exports

to China are still hitting record highs even as growth in the Chinese economy

slows. But investment in the mining

industry has dropped off as commodity prices have fallen. This leaves Australia in a tricky position as

money from mining has pushed up the cost of living, resulting in wages that are

too high to be competitive. Employment may

be starting to suffer - Your Neighbourhood Economist struggled to spot many

Australians among the cabin crew on the Qantas flights to and from London.

Two gauges of economic health augur tougher times

ahead. The central bank in Australia has

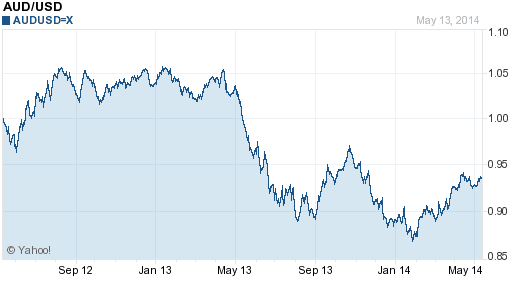

pledged to keep interest rates at a record low of 2.5% for some time. Along with this, the exchange rate for one

Australian dollar has dropped below parity with the US dollar after having been

worth more than its US counterpart in 2011 and 2012. In contrast, New Zealand has seen its dollar

continue to climb in value with the NZ central bank already having lifted

interest rates twice to 3.0% in 2014. It

is milk and cheese that is driving the upturn in the New Zealand economy with

the Chinese developing a taste for dairy products as their levels of wealth

expand.

Two gauges of economic health augur tougher times

ahead. The central bank in Australia has

pledged to keep interest rates at a record low of 2.5% for some time. Along with this, the exchange rate for one

Australian dollar has dropped below parity with the US dollar after having been

worth more than its US counterpart in 2011 and 2012. In contrast, New Zealand has seen its dollar

continue to climb in value with the NZ central bank already having lifted

interest rates twice to 3.0% in 2014. It

is milk and cheese that is driving the upturn in the New Zealand economy with

the Chinese developing a taste for dairy products as their levels of wealth

expand.

The shifting fortunes of Australia show that tapping into a

growing Chinese economy has its downs as well as ups. Despite this, New Zealand shows how change in

China can be turned into a positive. With

China as one of the few bright spots in the global economy, this is a story that

a lot of countries will be interested in.

Australia's cash rate is 2.5% and has been for quite some time now.

ReplyDeleteThanks for pointing out the mistake.

DeleteNot sure how I got it wrong but a correction has been made.

This comment has been removed by the author.

ReplyDeleteI really like this post. Purchasing in China & Logistics help in China

ReplyDelete